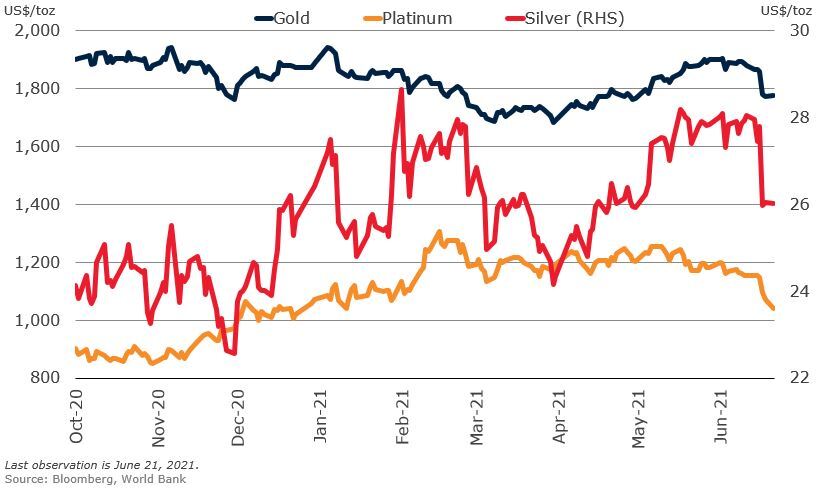

The second quarter of 2021 saw precious metal prices trend higher, but in the middle of June prices retreated substantially following a statement by the US Federal Reserve which signalled that the first interest rate increase in the US after the COVID-19 pandemic could happen as early as 2023.

Precious metal prices depend on three main factors: supply and demand, the global economy, and US monetary policy. The most astute commodity traders can often predict where these various forces will pull the price of silver or gold.

Where are precious metal prices headed in 2022? Many analysts are predicting that the price of precious metals will fall in 2022. The price will likely increase in the final months of 2021 but then enter a period of decline in the new year. The price of silver may stay about the same or soften slightly, while the price of platinum might increase by a modest amount.

What factors are pulling precious metal prices in either direction? Money printing, the global economy, and the demand for precious metals in technology and industry are all key factors.

What Affects the Price of Gold?

Anything that creates demand for gold tends to increase its price. Today, gold is not only useful for jewellery but also in technology as well. Many components in electronics and medical equipment need gold. Banks and governments store gold, and the gold price will increase if governments create demand by increasing their gold reserves.

Conversely, increased supply of gold will tend to cause its price to decrease unless there is an accompanying increase in demand. Supply will increase if gold mining and gold production increases. However, it is worth noting that gold mining output has been stable for the last few years.

People often use gold as a hedge against inflation – if the US dollar declines in value, the price of gold increases. As the buying power of the US dollar is eroded by inflation, those invested in gold will be compensated by the increase in the value of their gold in US dollars.

Other precious metals are somewhat similar to gold and can gain or lose value for similar reasons. Increased demand for jewellery or electronics raises the price, an increase in supply from mining lowers it. Money printing lowers the price of the dollar relative to silver or platinum.

Will the Price of Precious Metals Increase in 2022?

The World Bank is predicting that the gold price is likely to continue to increase between now and the end of 2021. However, it may not do as well in 2022 and will enter a period of uncertainty next year. Late 2021 probably won’t be a good time to buy gold.

The global economic recovery is likely to cause a decline in the gold price. As growth accelerates alternative investments will deliver superior returns and this will reduce the attractiveness of gold as an investment, leading to an environment of declining demand. Analysts estimate that the average gold price will be $1785 in 2022, compared to $1812 this year.

Will the price of other precious metals also experience a similar decline? Views are mixed but the consensus is that the silver price is likely to soften slightly in 2022 while platinum is expected to experience a modest increase. Silver is expected to rise 22% in 2021 on the back of increasing industrial demand in areas such as electronics, automobiles and solar power. Demand for silver as an investment has also been strong with investors holding net long positions since the middle of 2019.

Silver has outperformed gold in 2021 and this is why it is expected to modestly underperform in 2022. The view of analysts is that silver has run too far too fast and will experience some profit taking in the new year which is likely to keep a lid on the silver price.

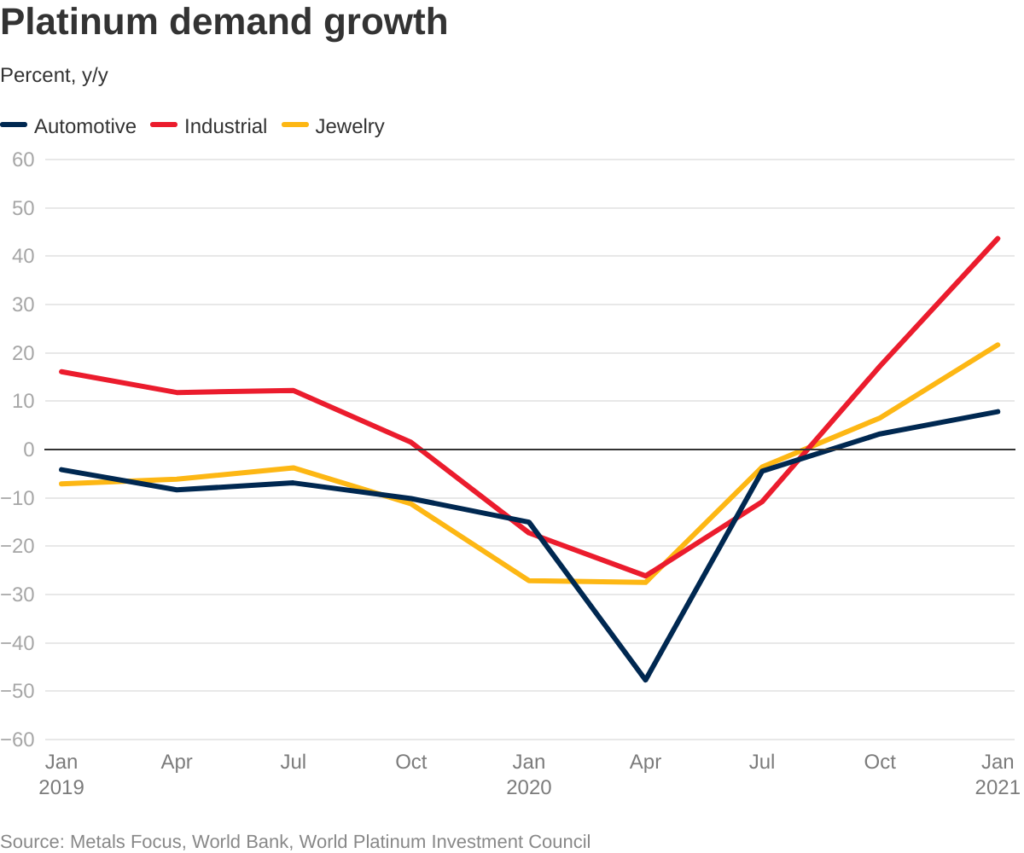

Platinum is expected to do better with jewellery demand remaining strong and demand from automakers likely to increase as tighter emissions standards in China and Europe boost platinum use in autocatalytic converters.

How Will Supply and Demand Affect the Price of Precious Metals?

Demand for gold falls when other investment opportunities improve. If bond rates are better, people turn away from gold and invest in bonds instead. More generous bonds in 2022 will be one factor that will help drive the gold price down.

People also buy gold when the world seems unstable. The COVID-19 pandemic unsurprisingly caused the price of gold to increase. With better medical defenses against the virus becoming available, the price may fall.

One could argue that the price of gold will increase for other reasons; perhaps inflation will continue to increase, or demand for gold jewellery might recover. However, analysts expect this to be outweighed by other factors and for the price of gold to fall.

Like gold, silver is becoming increasingly important for technology, not just jewellery. This increase in industrial demand has given the silver price a nice boost in the first half of 2021. Silver is used in electric cars, solar panels, and chargers, which are increasingly becoming high demand technologies.

Global Economic Trends and Precious Metal Prices

The global economy performed very poorly in 2020. The pandemic caused an historically deep recession that the global economy has taken some time to recover from. The pandemic continues to rage in many countries and will continue to impact the world economy in the near future.

However, the economy is set to recover and grow in 2022. This recovery may be very rapid. The pandemic continues, but its impact is in decline and does not seem to have the power to prevent a widespread economic recovery.

A better economy is likely to decrease rather than increase gold prices. People look to gold to protect their wealth in unstable times. If the world economy recovers, people may stop investing in gold to protect their wealth and look to other investment opportunities instead.

As such, we cannot expect people to continue to buy gold out of anxiety in 2022 and, as a consequence, a price decrease is more likely than a price increase.

Inflation, Monetary Policy, and the US Dollar

Decisions made by banks, the US treasury, and the Federal Reserve can all cause the price of gold to change substantially in a relatively short time. Plenty of US dollars have been printed in recent years, with the economic crisis created by the COVID-19 pandemic increasing the money printing as governments have attempted to inject money into the economy through spending.

The US dollar remains strong despite how much money has been printed since the beginning of 2020. Money printing is unlikely to lead to a US dollar crash as the US dollar remains the world’s strongest currency due to global confidence in the strength of the US economy.

Anything that increases the money supply, and not only printing, tends to increase the price of gold. If the economy is doing well, banks will sell gold to buy assets that generate a better return. Therefore, an economic recovery in 2022 is likely to result in a lower gold price.

Is it a Good Time to Invest in Precious Metals?

In the case of gold, it might be a good idea to wait and see how the rest of 2021 plays out. While the COVID-19 pandemic did increase the price of gold, the peak of that increase may have already passed.

It is unlikely that the price of gold will continue to remain this high for much longer, so it is reasonable to expect it to eventually experience a decline. Money printing may keep the price up in the short term, but it won’t be enough to prevent an eventual decrease. Analysts expect a decline in 2022, though they expect the gold price to bottom out around $1750 rather than the much lower 2019 average.

Silver and platinum might be better choices, but don’t expect huge increases. 2022 is likely to be a period of uncertainty for precious metals and caution should be exercised by investors until global economic conditions become clearer in the new year.