Company Overview

BrainChip Holdings Limited, formerly Aziana Limited, is an Australian-based company which is engaged in the development of neural computing technology. The Company focuses on its spiking neuron adaptive processor (SNAP) technology and licensing the SNAP technology with technology partners.

The Company operates through the technological development of designs segment. The Company’s SNAP offer a complete development solution for companies entering the neuromorphic semiconductor chip market. SNAP is a core enabling technology in Neuromorphic semiconductor chips that possesses various applications, such as gaming, cyber security, robotic technology and stock market forecasting, among others. SNAP also implements learning rules in hardware, enabling autonomous features extraction (AFE) directly from input data without the need for any software processing.

Its subsidiaries include BrainChip Inc., AZK Merger Subsidiary Inc., Aziana Exploration Corporation and Eternal Resources Pty Ltd.

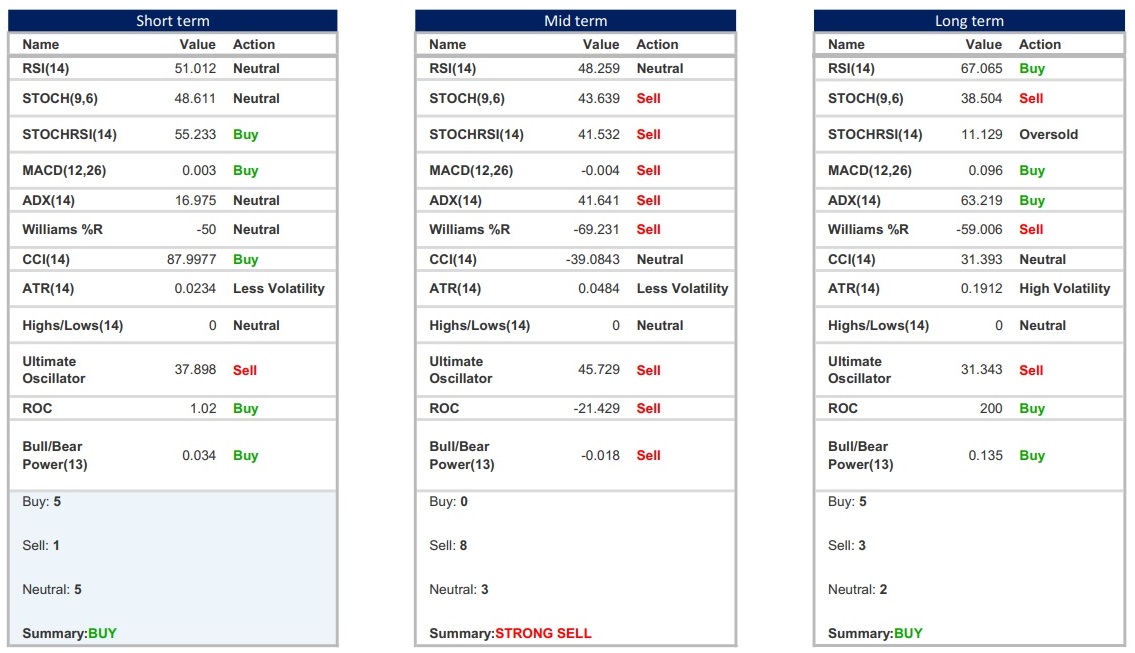

Technical Indicators

Chart

BRN is forming a consolidated triangle pattern with price trading between the two red trend lines since 9 March. It is a long term channel so when the price breaks out either to the upside or downside it will be a steep move. Price has been mostly respecting support at $0.46. However, if price breaks below that, the next level of support is at $0.365. If that fails then the next stop would be around $0.19.

On the upside, if there’s a break through resistance at $0.52 the next short term target would be $0.625. A bullish move through that level would make $0.795 the next target price.

Currently, caution should be exercised until BRN breaks through the upper trend line and demonstrates a clear bullish uptrend. There may be short term share price decline if BRN continues to trade between the two red trend lines without any clear direction.

Disclaimer: The above information is not financial advice, just general information about, and analysis of, Brainchip Holdings Limited and is not intended to be the basis for any financial decision. Always consult a licensed financial adviser for advice about any investment decision that puts your own capital at risk.